As noted in prior blogs, there is a tendency for mass mood and associated world history to peak around psychologically important thousand marks in the DJIA, the most widely watched barometer of economic and collective well-being. Upon reversals below these thousand marks, negative historical "shocks" sometimes occur seemingly out of the blue that setoff a downward trend in stock prices and mass mood.

This pattern is overviewed in my Stock Market Crash Alert that anticipated last year's autumnal panic on Wall Street, but, for the sake of clarity, I've put together some revised charts highlighting a few of the most obvious examples of this phenomenon.

If the DJIA fails at the 8000 mark here, then a new downleg in the Grand Supercycle bear market might unfold that has significant negative implications for world history. At the present time, it appears that this new downtrend may take the form of, at the least, a swine flu pandemic.

In 1966, the DJIA reached the "Magic 1000" mark for the first time in history and then reversed course:

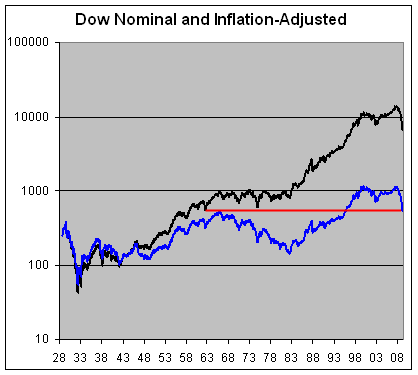

Following this top at Dow 1000, a 16-year bear market began on Wall Street that, adjusted for inflation, carried the DJIA down 74% from the 1966 peak by 1982:

This prolonged downtrend in stock prices and mass mood involved many negative historical events that fed souring popular sentiment. One of the most clear-cut examples of this occurred in October of 1973 when, upon retesting the "Magic 1000" mark, the DJIA turned down in connection with that month's Yom Kippur Arab/Israeli War which was followed by an OPEC oil embargo against the West and a severe contraction in the global economy. This was reflected on Wall Street with a 40%+ decline in stock prices:

On July 16th and 17th of 1990, the DJIA closed at 2999.75 two days in a row, not closing above the psychologically important 3000 mark until the following year. Just as the DJIA reached the 3000 mark, Saddam Hussein gave a speech threatening Kuwait on what was then Iraq's President Day honoring the date of the coup that brought the Butcher of Baghdad to power. That weekend, Iraq started massing troops on Kuwait triggering a 5% reversal in the DJIA from the 3000 mark. Then, on August 2nd, Iraq invaded Kuwait causing the Persian Gulf Crisis, a spike in oil prices and a 20%+ drop in the DJIA by October of that year. Thus, the reversal in mass emotion with a failure at Dow 3000 in the summer of 1990 manifested as Iraq's invasion of Kuwait and the beginning of what would be a prolonged struggle with Saddam Hussein's Iraq.

In early-September of 2001, the DJIA reversed below Dow 10,000....THEN 9/11 occurred precipitating a 20% drop in the stock market.

Thus, at the current junture there is the possibility that a reversal below Dow 8,000 will be met with a new historical shock and it appears increasingly likely that this will take the form of a swine flu pandemic (which may be a prelude to global war as highlighted in my prior blog).

All of this is profound evidence that deterministic cyclical swings in mass mood are the hidden engine behind human history:

However, this is not simply because of human nature as posited by Robert Prechter IMHO. I believe this phenomenon reflects our Creator's designs....i.e., this is proof of God's authorship of human history.

No comments:

Post a Comment