As I have been pointing out for years, there's a tendency for the stock market to top out around psychologically important thousand marks and, upon reversal, major historical shocks can occur.

Chris Carolan's Spiral Calendar has been pointing to this timeframe for a potential emotional extreme:

While I was concerned that this extreme would take the form of a mass panic potentially involving global war, fortunately we are instead seeing an extreme of collective optimism.

Are we now at the anticipated Primary Wave 2 top of the Elliott Wave Grand Supercycle bear market?

It's certainly likely.

Obviously the tendency for panic lows into the days around Tishrei 25 on the Hebrew calendar is misleading this year. Instead, the relevant force is the Spiral Calendar that predicts the non-linear periodicity between emotional highs and lows of Elliott Wave patterns in human history.

The Spiral Calendar is based upon the Fibonacci series and lunar cycles. It was discovered by Chris Carolan as he examined the correlations between the 1929 and 1987 stock market crashes:

While one aspect Carolan uncovered was the tendency for autumn panics in financial markets, another key pattern Carolan noted was that there was a specific time interval between the 1929 and 1987 stock market crashes predictable based upon the number of lunar cycles between the two historic events. More specifically, Carolan noted that the 1929 and 1987 stock market crashes were separated by 717 lunar cycles where 717 is the square root of the 29th number in the Fibonacci series.

The Fibonacci series is generated such that each number in the series is the sum of the two prior numbers in the series. Thus, if you start with 1 as the first number, you get the following series: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89...

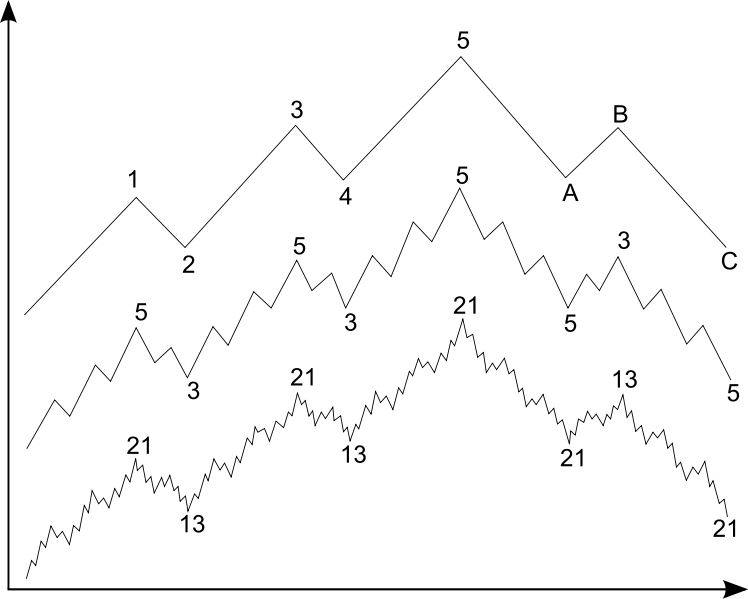

This series is relevant in Elliott Wave analysis because the wave pattern discerned by Ralph Elliott is fractal-based with Fibonacci relationships:

The 29th number in the Fibonacci series (1,1,2,3,5,8,13,21,34,55...) is 514229. The square root of 514229 is 717.0976. This is the exact number of lunations (lunar cycles from new moon to new moon) between the 1929 and 1987 stock market tops and crashes. More specifically, 717.096 mulitplied by 29.5306 (number of days in a lunar cycle) is 21176, the number of days between the 1929 and 1987 tops and subsequent panic lows (+/- 1 or 2 days) where the tops occurred on 9/3/29 and 10/25/87 and the subsequent panic extremes occurred on October 28/29 of 1929 and October 19th of 1987, respectively.

As Jim Ross has uncovered, Carolan's Spiral Calendar may be very relevant now because 2009 is proving to be analogous to 1929 and 1987. The 25th number in the Fibonacci series is 75025 of which the square root is 273.9. This number of lunations is equivalent to 8088 days. This is the time interval between the 1987 top and Friday, October 16th. (Notably, this time interval is a 38.2% of the time interval between the 1929 and 1987 tops where .382 is equivalent to 1.618 to the minus 2 power and 1.618 is the Fibonacci Golden Ratio, Phi, which is the ratio of two consecutive numbers in the Fibonacci series the further out you go, e.g., 55/34 is ~ 1.618.)

Are we about to see a top as significant as the 1929 and 1987 tops? Will this be followed by a major panic like occurred in those previous years? This is possible. Look at a chart comparison:

Here's the key dates pinpointed by Jim Ross using the 1987-2009 Spiral Calendar analogy:

If this analogy continues, the stock market would top here above Dow 10,000 and then a collapse would occur into December 10th of this year, the equivalent of October 19th, 1987 and 10/26/1929....approximately the time of the '29 Crash.

Notably, as is apparent from my prior related blog, a crash low into 12/10 is not consistent with the seasonal pattern for mass panics which typically climax around Tishrei 25 on the Hebrew calendar. Thus, I consider a crash into early-December a low probability forecast, but we'll see if the parallel pattern continues in the days and weeks to come. (Note that Chris Carolan is doubtful as well.) At the least, a major peak above Dow 10,000 in the days ahead seems to be a reasonable expectation and in its wake Primary Wave 3 down in the Grand Supercycle bear market should ensue with potentially biblical implications for human history.

2 comments:

Hello,

I have been studying via your article the changes in the Dow. I built an excell file, and I got ,multiple results or alerts. How does one know which spiral date will be effective? for instance,If I take April 26, 2010 and add the days, I get Fibo 89= 278 days for Jan.9.2011, April 15, July 20, &Nov 20 by adding Fibo 377. If I take Jan 20 , 2010 as a start, by adding 377 I got today as a turn.

thank you for your answer..

Best regards,

Gabriella

PS> you are welcome to visit my financial astrology blog at : www.astrologyandthemarkets.bolg.spot

Interesting. See: http://spiraldates.com/?p=811

Not sure on your math. I always abide by the Fibonacci RATIO series, i.e., 1.618^X

Post a Comment